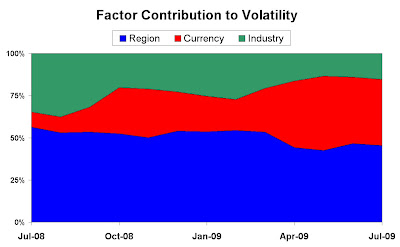

So how has all of this movement affected the distribution of risk in global equity portfolios? Consider the contribution of the three major areas of global risk and how they contribute to the overall risk of the MSCI World Index from the perspective of a USD-denominated investor. I have used the R-Squared Global Risk Model for this analysis; results are similar when generated using Barra and Northfield.

We can see from the chart above that the last 12 months have seen Currency Risk contribution increase far beyond that generated through Sector Risk, i.e., it is now more important to get your portfolios currency exposure right than to worry about your sector allocations.

The overweighting of the S&P500 in Information Technology would have a negative relative effect with the strong Dollar affecting the returns of large exporters such as IBM, Apple, Microsoft, etc. The relative underweighting of the S&P 500 in Financial stocks (e.g., 14.9% vs FTSE 100 >21%) where through globalisation most have a large exposure to the U.S. (e.g., HSBC and Barclays), would generate a positive return, as would the Materials sector where the low exposure to commodities (all priced in USD) is a boon (i.e., no exposure to BHP Billiton, Rio Tinto, etc.)

The overweighting of the S&P500 in Information Technology would have a negative relative effect with the strong Dollar affecting the returns of large exporters such as IBM, Apple, Microsoft, etc. The relative underweighting of the S&P 500 in Financial stocks (e.g., 14.9% vs FTSE 100 >21%) where through globalisation most have a large exposure to the U.S. (e.g., HSBC and Barclays), would generate a positive return, as would the Materials sector where the low exposure to commodities (all priced in USD) is a boon (i.e., no exposure to BHP Billiton, Rio Tinto, etc.)

Therefore, if the models are telling us that equity risk is predominantly a currency call and a strengthening in the dollar negatively impacts the S&P less than the rest of the world, then if I were a U.S. investor, there'd be no place like home.

To receive future posts by e-mail, subscribe to this blog.

No comments:

Post a Comment