With that in mind, I'd like to touch on the risk attached to currencies for a global investor.

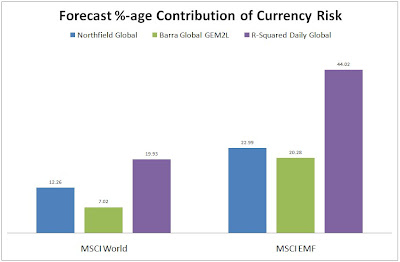

Let's consider the risk impact of currency by examining a couple of global benchmarks, namely MSCI Developed World and MSCI Emerging Markets. The first chart below highlights the contribution of currency risk to the total forecast risk profiles of the two indices from the perspective of a U.S. Dollar investor, the second shows that all our risk models have a similar spread between Developed and Emerging markets.

As you would expect, Emerging Markets consistently shows a much higher currency risk (50% of MSCI World is USD-based) but even that has risen to just short of 25%. This high is reflected in Developed markets too and with the above arguments in mind I see no reason that it should fall.

But what difference does currency actually make and is there anything that can be done about it? To answer these questions I looked at the previous 12-month performance (March 2008-March 2009) of the above two indices from the perspective of a U.S. Dollar investor that has no currency hedging in place and one that is 100% hedged. (Read here for more information on hedging.)

We can see that in both cases the contribution to performance on currency was very material.

We can see that in both cases the contribution to performance on currency was very material.

What I am looking to highlight is not the benefit of hedging in to USD, (indeed had the investor been Euro-based then the hedged indices underperformed by 4.5% and 5% respectively), but that currency risk is a very real consideration for managers today. The current currency contribution to overall risk was about half 12 months ago as it is today while equity markets are just as risky, if not more so.

Tell us: If you are a global investor, what are you doing to handle your currency risk exposure?

To receive future posts by e-mail, subscribe to this blog.

No comments:

Post a Comment