Specifically I wanted to determine if investors were rewarded or penalized for investing in more concentrated strategies relative to more diversified portfolios. To investigate, I used the Morningstar U.S. Large Cap Equity Universe as my sample and quintiled the funds in that universe based on their number of holdings. I then used FactSet to calculate various measures of performance and risk for the first (most diversified portfolios) and last (most concentrated portfolios) quintiles. To allow for easy comparison I calculated averages for the quintiles at each point time for statistical measures I had chosen. I chose to focus on the period of January 2008 to October 2009 (the most recent 22 months). Since these are all supposed to be large cap portfolios, I used the S&P 500 as my benchmark for any benchmark relative calculations.

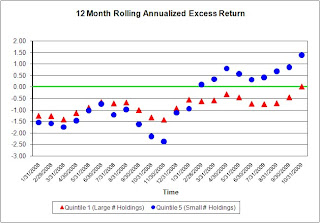

Let’s take a look at the results. First things first: how did the two groups compare in terms of performance? As you can see from the below chart, neither the Diversified (Q1) nor the Concentrated (Q5) groups outperformed the S&P 500 for first 13 months, though during this time the average of Quintile 1 portfolios clearly outperformed the average of Quintile 5 portfolios. What we can also see is a significant and consistent change of fortunes from February 2009 onwards, where Q5 seemed to benefit significantly from the market upswing.

The main thing I would like to understand is whether the improved performance we see above was achieved as a result of taking on substantially more risk. Also, on a risk-adjusted basis, which group of portfolios outperformed the other? Let’s take a look at a few different measures to see if we can uncover any trends.

The main thing I would like to understand is whether the improved performance we see above was achieved as a result of taking on substantially more risk. Also, on a risk-adjusted basis, which group of portfolios outperformed the other? Let’s take a look at a few different measures to see if we can uncover any trends. Above we see the average volatility of the two groups of portfolios over time. The chart clearly shows that in terms of absolute volatility there is actually little difference between the two groups of portfolios over the last 22 months.

Above we see the average volatility of the two groups of portfolios over time. The chart clearly shows that in terms of absolute volatility there is actually little difference between the two groups of portfolios over the last 22 months. Now when we look at a relative measure of risk like the above Tracking Errors relative to the S&P 500 we do see that, as expected, the more concentrated portfolios (Q5) appear more risky relative to the broad market index. To answer our questions, we need to determine whether or not the managers of concentrated portfolios were able to more efficiently manage their portfolios by adding appropriate levels of performance for their increased relative risk.

Now when we look at a relative measure of risk like the above Tracking Errors relative to the S&P 500 we do see that, as expected, the more concentrated portfolios (Q5) appear more risky relative to the broad market index. To answer our questions, we need to determine whether or not the managers of concentrated portfolios were able to more efficiently manage their portfolios by adding appropriate levels of performance for their increased relative risk. To wrap things up, I examined the average annual Information Ratios of Quintile 1 vs Quintile 5, and it does appear that more concentrated portfolios (Q5) on average do a better job of managing the risk-return tradeoff as evidenced by the higher IRs. Obviously this is far from conclusive, but my quick analysis of the situation indicates that during the period of high volatility we have seen over the last 12 months or so, the more highly concentrated portfolios have done a better job than their highly diversified peers.

To wrap things up, I examined the average annual Information Ratios of Quintile 1 vs Quintile 5, and it does appear that more concentrated portfolios (Q5) on average do a better job of managing the risk-return tradeoff as evidenced by the higher IRs. Obviously this is far from conclusive, but my quick analysis of the situation indicates that during the period of high volatility we have seen over the last 12 months or so, the more highly concentrated portfolios have done a better job than their highly diversified peers.

So maybe my mother was right; if you concentrate you will do better. I would like to know what the general consensus is amongst our readers – during volatile times would you rather hold a highly diversified portfolio or a very concentrated one, and why?

To receive future posts by e-mail, subscribe to this blog.

No comments:

Post a Comment