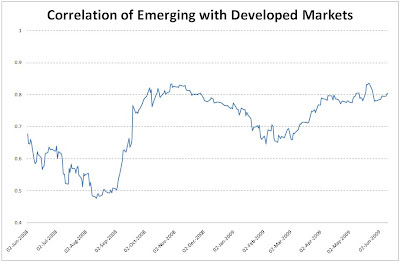

Having had little evidence of this decoupling elsewhere I was intrigued by this opinion, so I did a quick check of the performance changes indirections of the two markets. Using the same methodology as in my previous blog, I looked at the rolling 60 day correlation of MSCI Emerging Markets with MSCI The World.

This chart would suggest that decoupling is one thing that is definitely not happening. Over the period of the chart, we see how from early June 2008 through August the two equity markets were moving less and less in step as the perception of trouble was that it was all Developed in nature focused on the Financial Sector. As realization dawned in September that the trouble was much less constained and much more endemic, we saw the correlation rise, peaking at the end of October when the geographical nature of equity was considered irrelevant.

A steady decrease in correlation through the end of February reflects investors gaining further insight into any quality of earnings, levels of exposure, etc. from when the "rally" has lead to massively increased correlations, back to near-October levels.

I do see what John is looking to highlight in his article -- the continuing outperformance of emerging markets on a relative basis -- but I do not think that this due to decoupling of the markets. This data suggests that the call continues to be whether one should be in equities at all, not whether they should be in developed or emerging.

To receive future posts by e-mail, subscribe to this blog.

No comments:

Post a Comment