These sensitivities are often a reflection of conviction for the future, overweight/overexpose those areas that you believe will outperform and vice versa.

A further critical by-product of this analysis is to highlight sensitivites to areas that are in contradiction of those beliefs, or even where an opinion might not be held, but exposure is significant. Some of these risks may be inherent in the nature of the investment. For example, it is very difficult to invest in an energy supplier without taking on an exposure to a market cap based factor such as size. Even so, while it may not be possible to diversify these risks, it is imperative that we are aware of them, so identification is important. This is an area where risk model definition should be picked to suit the preferences of the manager.

To highlight this, I looked at an emerging market country, South Korea, and what its major risk drivers are now. (For this analysis I have selected the R-Squared risk model but this can just as easily be done with any of the risk models carried by FactSet.)

The three main drivers of risk according to the model are: Emerging Asia, Electronic Technology, and the Euro.

The global nature of the model with its regional classification explains the first factor, and with >22% by weight in the Electronic Technology Sector (FactSet definition) one would expect a large sensitivity to movements there. The factor that does stand out however, is the forecast risk coming from an exposure to the Euro. This is Korea!

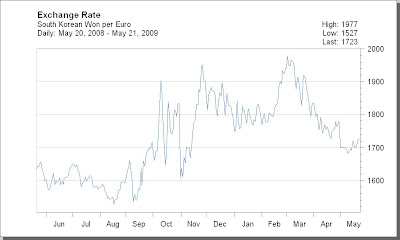

Let's drill down a little further and see the individual stock names that supposedly contribute to this exposure: Samsung Electronics and LG Electronics combine to about 20% by market cap. Samsung and LG Electronics both sell a huge amount of their products into Europe -- 45% & 22% respectively as of their last reported financials. Look at the chart below of the movement in the exchange rate for SKW/EUR and suddenly the potential impact of this exposure makes sense.

Anyone investing in Samsung is aware of this. I am not highlighting anything new here but merely trying to show how potential "torpedoes" can be identified.

Anyone investing in Samsung is aware of this. I am not highlighting anything new here but merely trying to show how potential "torpedoes" can be identified. How do you find out where all your risks are?

Get new Taking Risk entries delivered to your e-mail as they are posted.

No comments:

Post a Comment