Any portfolio manager constructing a fund using an existing risk-aware framework will see that his active positions will be smaller than historically and that his portfolios are much closer aligned with their benchmarks. To prevent drift from those benchmarks there will be increased turnover in smaller positions, which in turn leads to an increase in transaction costs. What is causing this change in behaviour with its subsequent "performance drag"?

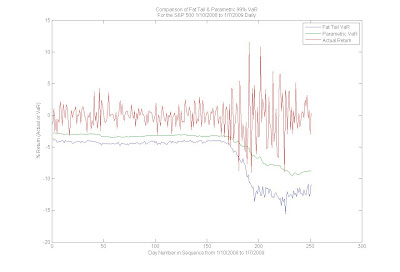

The answer is a marked increase in volatility. The turmoil in the markets over the last 18 months or so has led to a huge increase in the volatility of the world’s equity markets as highlighted below in the current levels of the VIX. We see that despite today’s value well below October’s highs we are still at levels last experienced in the market lows of September 2002, about double the normal levels.

So how does increased volatility feed through to portfolio construction? Let’s consider this from the reverse angle, using Implied Alpha. In a portfolio, a stock’s Implied Alpha is the required expected outperformance of that stock for the existing portfolio to be considered optimal. It specifically quantifies the magnitude of a more general conviction that may be apparent through an under/overweight. The general definition is:

Assuming that a manager is constant in his appetite for risk and that his mandate has not changed in terms of permitted active bets etc., then we can see that a jump in portfolio risk brings a corresponding jump in implied alpha. In other words, a manager taking an active position similar in magnitude to a year ago has an implied conviction of much higher outperformance. Consider this the other way round: In January 2008, a 3% overweight in Exxon vs SP500 had an implied alpha of 35bps, but the same alpha today would only require a 1.7% overweight.

Assuming that a manager is constant in his appetite for risk and that his mandate has not changed in terms of permitted active bets etc., then we can see that a jump in portfolio risk brings a corresponding jump in implied alpha. In other words, a manager taking an active position similar in magnitude to a year ago has an implied conviction of much higher outperformance. Consider this the other way round: In January 2008, a 3% overweight in Exxon vs SP500 had an implied alpha of 35bps, but the same alpha today would only require a 1.7% overweight.What do you think? Is the tail wagging the dog? Share your opinions below.

Get updates to this blog delivered to your inbox.

Get updates to this blog delivered to your inbox.